Our global economic system relies on a wide range of financial services to operate. From bank loans to public offerings of shares and from insurance to trade finance. Most of these financial transactions will have an impact on the natural world: directly, for example, through a loan to a timber extraction company, or indirectly, perhaps through a bond deal for a retail clothing company that sells products manufactured from viscose (derived from wood pulp). If we are to halt biodiversity loss, one thing is certain – the finance sector needs to be part of the solution.

Nature in decline

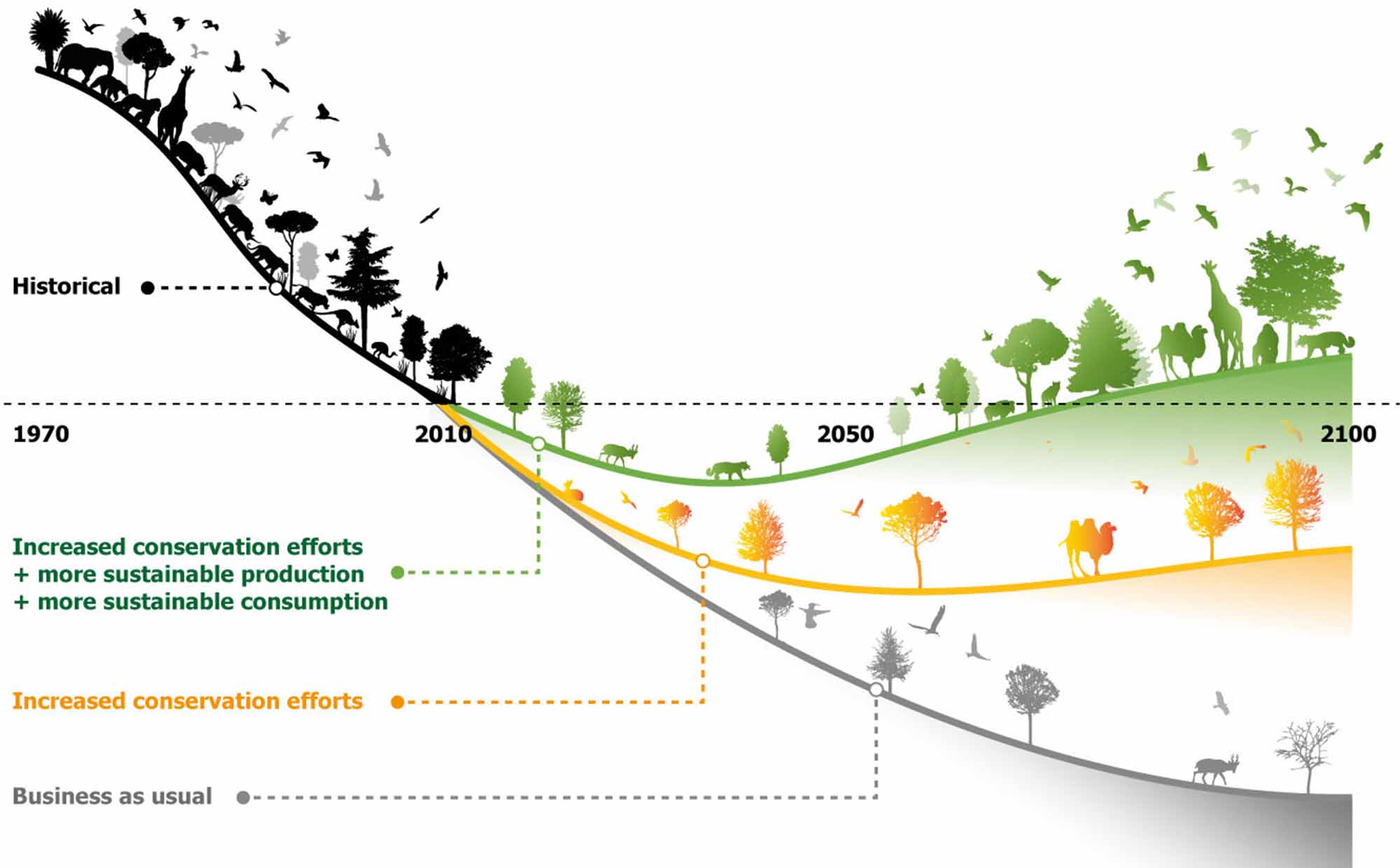

The 2020 Living Planet Report from WWF and ZSL, tells us that wildlife populations have fallen by an average of 68% since 1970. Sir David Attenborough has just released his very personal film, ‘A Life on our Planet’, a deeply felt plea for change in which he shows how life on Earth has declined over his lifetime. Whilst we wait for governments to show leadership by committing to ambitious targets under the Convention on Biological Diversity (CBD), next year, we already know where some of the most important changes need to happen. Scientists are agreed that we need to achieve, ‘No Net loss of Biodiversity by 2030’, to ‘Bend the Curve’ and halt nature’s decline. What does this mean for businesses and how can the finance sector play a key role in getting financial flows to work for – not against – nature?

Source: Leclère, D., Obersteiner, M., Barrett, M. et al.Bending the curve of terrestrial biodiversity needs an integrated strategy. Nature 585, 551–556 (2020)

We have already seen how campaigns to address climate change have shifted the policy dialogue and there are signs that this is beginning to happen on biodiversity issues. Consumer awareness is increasing, as more people are looking to take action to protect nature through their everyday choices: the products they buy; how they invest their savings and pensions; and through increased shareholder action to put pressure on companies to align their businesses with global targets for climate and biodiversity.

The direction of travel is clear, but we need to move faster.

Finance and Biodiversity today

By financing activities across a wide range of sectors, many banks and investors continue to be leading contributors to biodiversity loss. Two reports published this year identified key sectors that have the greatest impact on biodiversity. The World Economic Forum’s, ‘The Future of Nature and Business’, July 2020, highlighted key sectors where action is needed:

- Food

- Land and Ocean Use

- Infrastructure and the Built Environment

- Energy and Extractives

Meanwhile, a report from UNEP-WCMC, ‘Beyond Business as Usual: Biodiversity Targets and Finance’, June 2020, identified the same sectors, whilst also giving additional sub-industry sectors, including:

- Apparel

- Accessories and Luxury goods

- Brewers and Distribution.

We know where action needs to be focused and there is broad agreement that, from the sectors above, agriculture has the greatest impact on biodiversity.

Industrial agriculture. Image © Shutterstock

‘No net loss’ requires a paradigm shift in how businesses and the finance sector operate. So where is the finance sector starting from? Earlier this year, Share Action, a UK-based NGO that works to promote an investment system that works for savers and communities and that protects the environment, published their Asset Manager rankings. This assesses the world’s 75 most influential asset managers on their responsible investment governance for human rights, climate change and, for the first time, biodiversity.

This report clearly shows that governance of biodiversity risks, impacts and dependencies is well behind governance on climate change.

The majority of asset managers’ policies on biodiversity remain critically undeveloped. None of the managers had a stand-alone, dedicated policy covering all portfolios under management. Just 32% had some mention of biodiversity related to responsible investment, while 68% had no mention of biodiversity in any public investment policy.

Looking specifically at deforestation risk, in September 2019 Global Witness produced a report, ‘Money to Burn’, which showed the funding links between banks and companies that were directly or indirectly associated with deforestation.

Gold mining in Guyana, South America. Image © Shutterstock

The future for Finance and Biodiversity

We know the key sectors to focus on and there is plenty of data available for the finance sector to engage companies on biodiversity risks and impacts. A number of NGOs provide detailed, company-level information on many of these sectors; ZSL SPOTT, CDP Forests, Canopy Planet Hot Button Ranking, Carbon Tracker, Global Canopy Forest 500 and TRASE are just some of the initiatives that provide the information needed to understand the risks and impacts of companies on the ground.

However, producing standardised biodiversity footprint metrics for companies remains extremely challenging.

A wide range of metrics have been developed – and continue to be developed – however, the missing piece of the puzzle for these to be useful is usually the lack of transparent supply chain information for companies.

In addition, there is limited information on the locations of company operations and activities. Biodiversity impacts are very location specific, so footprints require at least regional information on the location of raw material production. Even for companies that operate further up the supply chain, the greatest impact on their biodiversity footprint will usually be the production or extraction of raw materials for their products.

Workers picking cotton, Adana, Turkey. Image © Shutterstock

Some companies are beginning to build biodiversity into their strategies. For example, Kering, a luxury goods company, recently reported on their biodiversity strategy, in which they commit to ‘a net positive impact on biodiversity by 2025’. The largest biodiversity impact was not from their direct operations, but from their raw material supply chains, particularly their cashmere supply chain. As a result, they have committed to regenerate one million hectares of farms and rangelands to reach a net positive biodiversity outcome for their business.

This shows the importance of greater transparency from companies. The finance sector can play an important role in pressing for more detailed supply chain information from the companies they invest in and make loans to. However, the sector also needs to invest in biodiversity expertise and tools to properly understand the information and outputs and to then integrate these into decision making. Whilst systematic biodiversity metrics may be a few years away, there is already enough information for the finance sector to make significant progress on engaging companies in the key impact sectors now.

Signs of progress

There are some bright spots of activity that show the direction of travel. In June 2020, the Dutch National Bank and the PBL Netherlands Environment Assessment Agency produced a groundbreaking report, ‘Indebted to Nature: exploring biodiversity risks for the Dutch financial sector’. The report used location data just for multi-national companies to assess place-based deforestation and protected area risks, as well as considering reputation risk and nitrogen emission risk.

It revealed that the biodiversity footprint of Dutch financial institutions is comparable to the annual loss of over 58,000 km2 of pristine nature (the Netherlands has an area of 41,800 km2).

One Dutch bank, ASN Bank has already committed to ‘Net Biodiversity Gain’ by 2030 and developed a Biodiversity Footprint for Banking to track progress.

The debate on biodiversity risk has also moved beyond equity exposure (risk to the share price of a company) to consider fixed income (risks to company debt) and sovereign debt risks (risks to borrowing by countries to fund national deficits). Planet Tracker, having expanded the work of Carbon Tracker, is exploring how changes in ecosystem values impact projected returns on sovereign investments. Their report, ‘The Sovereign Transition to Sustainability; Understanding the Dependence of Sovereign Debt on Nature’, specifically considers the exposures of Argentina and Brazil to biodiversity and climate risks.

WWF has worked with Ninety-One, an asset manager, to produce a Climate and Nature Sovereign Index, CNSI, producing a risk ranking for countries, which can be used in relation to sovereign bond risk and also as a country risk metric for company assessments.

In France, an amendment to the French Energy Transition Law, requiring companies and investors to disclose biodiversity impacts, has led to encouraging innovation within the French finance sector. The EU is also consulting on the Sustainable Finance Disclosure Regulation (SFDR), which specifies minimum reporting metrics for a wide range of ESG issues, including biodiversity.

The need for deep cultural change

Most of us are ‘unconscious allies’ of the companies that are destroying biodiversity around the world. We have pensions and savings that include these companies and we feel we don’t have the information or expertise to ask the right questions. A new initiative, ‘Make my Money Matter’, is campaigning for ‘Pensions with Intention’, addressing a wide range of sustainability issues, from health and social housing to biodiversity, to shift the £3 trillion of pension investments in the UK to deliver better solutions for all of us. They found that 68% of UK savers want their investments to consider people and planet alongside profit.

Climate protest, New York. Image © Shutterstock

Demand for sustainable investment products has clearly increased and the specialist impact and sustainable investment companies have shown how in-depth research and new approaches to impact assessment can deliver investment strategies that offer solutions to climate and biodiversity challenges. However, this can’t remain a ‘niche’ activity.

Changes to regulation to support global goals are essential, but even more important is a deep cultural change within society and the finance sector that embraces the natural world as our life support system and as an evolutionary marvel.

Unless financial companies decide that their teams should include biodiversity specialists and that they are also willing to commit to ‘No Net Loss’ to Biodiversity by 2030, we will fail to see the paradigm shift we all need. Financial flows should work with nature and help protect and restore our natural world.

Synchronicity Earth is currently working to scale up and adapt its Regeneration initiative to provide opportunities for the finance and business communities to contribute to the conservation, regeneration and restoration of vital ecosystems around the globe. Our aim is to facilitate a greater flow of finance towards partners and projects whose work conserves ecosystems, restores critical biodiversity, keeps carbon out of the atmosphere and benefits local communities.

If you would like more information on this initiative, contact us on: info@synchronicityearth.org