When it comes to the ‘E’ in ‘ESG’ (Environmental, Social and Governance), impact on biodiversity is often overlooked compared to climate action. A ShareAction report on asset managers’ approach to biodiversity has highlighted the main reasons why biodiversity is excluded and what can be done to move the finance sector towards a net positive impact on the natural world.

In 2020, various initiatives arose to push the finance sector towards a more positive impact on biodiversity: European investors calling for impact measures; the Taskforce on Nature-related Financial Disclosures was announced; and the Finance for Biodiversity Pledge was launched.

Meanwhile, our partner ShareAction was interviewing various stakeholders for a report assessing where the finance sector currently stands on biodiversity and learning what tools the financial system needs to increase action.

Image: llee_wu CC BY-ND 2.0

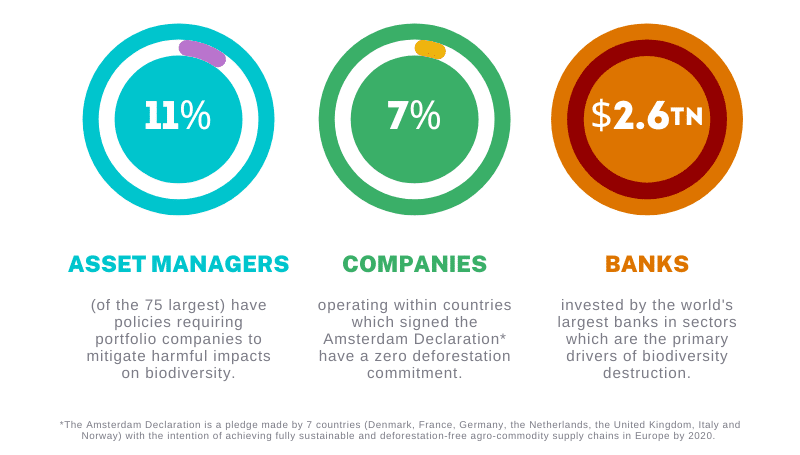

Unlike climate change, they found that few investors at the time of the study planned to establish commitments around reducing biodiversity loss, indeed none of the 75 largest asset managers had a dedicated policy on biodiversity and only 11 per cent of asset managers have policies requiring portfolio companies to mitigate harmful impacts on biodiversity. Then looking at the minority within a minority (companies that not only look at environment, but specifically biodiversity), deforestation-related policies are at the forefront, leaving freshwater, overfishing, and ocean health overlooked.

When it came to risk, asset managers identified biodiversity-related portfolio risks less systematically than they do for climate change. Legal, regulatory, and reputational risks were the most commonly identified biodiversity-related risks, such as liabilities due to poor environmental management or pesticide regulations. On the other side, the most common opportunities cited related to biodiversity were circular economy solutions (e.g., recycling and waste management) and sustainable agriculture.

Other actors in the economy such as companies and banks were often leaning towards greenwashing (making claims of positive environmental impact without true commitment) or simply overlooking biodiversity-related impacts altogether. The Bankrolling Extinction report by Portfolio Earth revealed that in 2019, the world’s largest banks invested more than USD 2.6 trillion (equivalent to Canada’s GDP) in sectors that governments and scientists agree are the primary drivers of biodiversity destruction. However, though still currently far too low, demand from the clients of asset managers is rapidly growing, but the constant refrain is: how can they measure their impact?

Sustainable agriculture was one of the perceived opportunities around positive biodiversity impact cited by asset managers. Image: UGA CAES CC BY-NC 2.0

Measurement and impact: the chicken and the egg

The report refers to measurement approaches as a “work in progress and not a ‘silver bullet’”. All participants flagged that there is a lack of an agreed methodology to measure and quantify impacts on biodiversity at the portfolio level.

Although there are multiple efforts ongoing to try to measure biodiversity impacts at site, asset, and portfolio level, some participants were concerned that these parallel efforts would only confuse the problem, and not give investors a clear yardstick with which to compare their performance against their peers.

Sustainably managed wastewater treatment represents an investment opportunity that will positively impact freshwater biodiversity. Image: EandJsFilmCrew CC BY-ND 2.0

Participants said that advances had been made in measuring species diversity impacts, but these metrics leave behind other important components of biodiversity such as ecosystem health, genetic diversity, and nature’s contributions to people.

The challenges of the Convention on Biological Diversity’s (CBD) new framework, aiming to “have focused, concrete and measurable Action Targets, so that their implementation and impacts can be monitored and assessed” were in interviewees’ minds. But many investors expressed scepticism that without governments adopting national strategies that feed into this framework, creating targets for the private sector on a country-by-country basis, it would not be effective. Indeed, few investors had plans to integrate the framework.

Much as financial institutions are driven by numbers, one of the experts interviewed is quoted in the report summarising one of the leading issues: “We don’t want to procrastinate and [avoid] doing anything around management because we don’t have enough information – we know what’s enough.”

A mural project in Waikerie, South Australia, representing the community’s ties to the River Murray and its wildlife. Image: Denisbin CC BY-ND 2.0

What’s next?

In its conclusion, the report says that tackling biodiversity loss is blocked by several conceptual barriers for investors, and these need to be dismantled. It suggests that the relationships between biodiversity loss and climate change, human rights, and inequality should be made clear, to help decrease the corporate fatigue related to climbing the mountain of addressing a ‘new’ problem.

ShareAction see an opportunity to educate and mobilise financial actors now, despite the measurement and impact data not being comprehensive yet. Alongside this, the report states that regulation that translates global biodiversity goals into targets for the private sector is key to this process. Ideally these would help bridge the gap between the impacts of biodiversity loss and the companies which cause them, helping investors and banks recognise the financial risk in their portfolios and respond accordingly (and preferably swiftly).

The Point of No Returns: Biodiversity report by our partner ShareAction can be read here. It is the last in a series of four reports assessing the global asset management industry’s approach to responsible investment, the others focus on responsible investment governance, human and labour rights, climate change, and leading practice.

Following this report, ShareAction are developing a biodiversity programme to mobilise the investment and banking communities to overcome the challenges associated with corporate activity within biodiverse areas across the world. Follow ShareAction on LinkedIn and Twitter and subscribe to their email newsletter for regular updates on their work.

Synchronicity Earth supports ShareAction as a partner within the Synchronicity Portfolio. If you are interested in learning more and supporting projects influencing systemic change for biodiversity, please contact us.